Purpose-Built for Security & Alarm Contracts

Unlike generic eSignature platforms, Loyva is tailored to the compliance, funding, and operational needs of alarm dealer contracts from day one.

Banks play a critical role in helping security and alarm dealers grow their recurring monthly revenue (RMR). But outdated, paper-based processes can create delays, introduce risk, and make it harder to scale dealer financing programs.

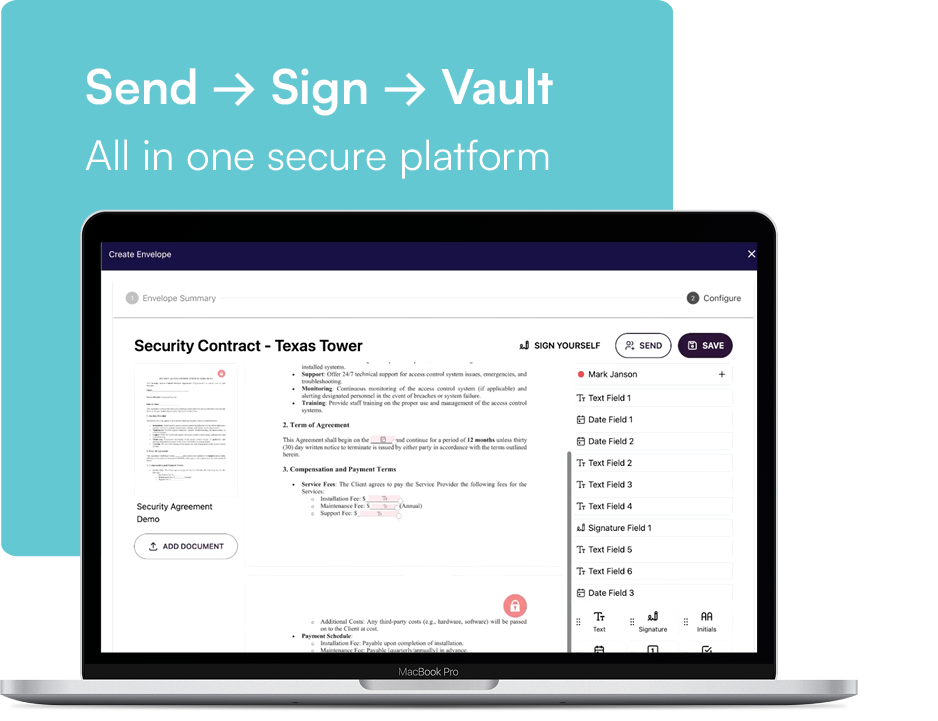

Built specifically for the security and alarm industry, Loyva provides a digital vault and eSignature solution that makes contract management faster, more secure, and fully compliant—helping your bank and your dealers operate with confidence.

Unlike generic eSignature platforms, Loyva is tailored to the compliance, funding, and operational needs of alarm dealer contracts from day one.

No hidden fees. No bloated features. Loyva gives you the tools you need, at a price that makes sense for both you and your dealers.

A simpler, faster platform means more dealers onboard, more contracts submitted, and more RMR-backed lending volume for your team.

Signed contracts are vaulted instantly and accessible in real-time—giving your lending team full visibility without the paperwork chase.

Security Integrators use Loyva to send and sign customer contracts

Signed contracts are automatically vaulted and available to the bank

Your team reviews, approves, and funds—all in one streamlined workflow

AES-256 encryption in transit and at rest.

with two-factor authentication.

Under UCC-9-105, ESIGN & UETA

Loyva isn’t a generic solution retrofitted for your needs. It was purpose-built for the unique compliance, workflow, and financing requirements of the security and alarm industry.

Whether you're funding residential alarm contracts or commercial security system installations, Loyva provides the tools to:

Support RMR-based lending

Improve contract quality and traceability

Eliminate manual handoffs and delays

Reduce risk and gain confidence in your portfolio

If you’ve been recommending eOriginal or similar platforms, it’s time to consider a better alternative. Loyva is already helping banks like yours:

Reduce time-to-funding by up to 30%

Cut digital contract costs in half

Increase dealer participation with an easier workflow